Wise Traders Should Believe in Analysis, not Forecasting

Analysis is defined as detailed examination of anything with the goal of understanding more about it. In the financial market, analysis refers to a detailed study of an asset price movement and its intrinsic value.

Forecasting, on the other hand, refers to the process of predicting the future of something. In finance, forecasting involves predicting the future price of an asset like a stock, currency pair, and commodity.

In this article, we will look at Nicolas Darvas quote, which said.

“I believe in analysis and not forecasting.”

Analysis vs forecasting

Analysis is the process of conducting an in-depth study of an asset. As we will explain below, there are numerous methods of analysis in the financia market.

Forecasting is predicting what will happen in the future. Most traders use analysis to forecast the future movements of an asset.

Who was Nicolas Darvas?

Nicolas Darvas was a dancer, author, and self-taught investor. Born in 1920, he died in 1977 with significant success in the financial market. His success is a clear evidence that you do not need to have an ivy league education or many years of experience to succeed in the financial market.

Darvas is widely-known for his book, How I made $2,000,000 in the stock market. He was also the author of The Anatomy of Success. These books have sold millions of copies in the past few decades and have biome some of the most quoted in the industry.

Darvas was originally a dancer who toured several countries. He developed his love for the financial market after reading several books, including ABC of Investing, Your Investments, and You can make money on the stock market.

Do you need inspiration? Here are other evergreen trading books to read.

Transitioning to trading

Nicolas career is further evidence that anyone can move from other careers to become well-performing traders.

At DTTW™, we have seen thousands of people without any trading experience become highly successful traders. Some of these people have grown to become floor owners themselves.

Most of these people become successful by focusing on learning and improving themselves. Fortunately, there are many resources that are available to help you become better traders.

As with the quote, “I believe in analysis and not forecasting”, most of these traders focus on doing in-depth analysis and not merely forecasting.

Related » How to Start Day Trading (Figuring out if It's Right for You)

Why does trading analysis matter

Trading analyis refers to the process of conducting an in-depth study or examination on a financial asset like stock, commodity, or index. The goal is to understand its previous price action and then using this information to predict the future.

Related » How to Conduct a Financial Analysis of a Stock

Trading analysis matters for several reasons. Each of these points is essential if you want to have a long trading career and want to trade the markets at a higher level than you would as a hobby.

First, it plays an important role in separating trading from gambling. When you analyse a stock or currency pair well, you are at a good position for making informed decisions. For example, when you buy a stock after it moves above the VWAP, you can justify the reason for doing that.

Second, it matters because it will help you to transition from a novice into a professional trader within a short period. People who are perfect at analysis are able to become better traders and investors.

Third, it helps you avoid making common mistakes that many traders make like overconfidence and overtrading.

Finally, good analysis will help you manage your risks well. As we have covered before, risk management is one of the most important aspects of day trading.

Related » “Risk Comes from Not Knowing What You're Doing”

Types of analysis in trading

There are different types of analysis in the financial market. Some of the top methods of analysis are:

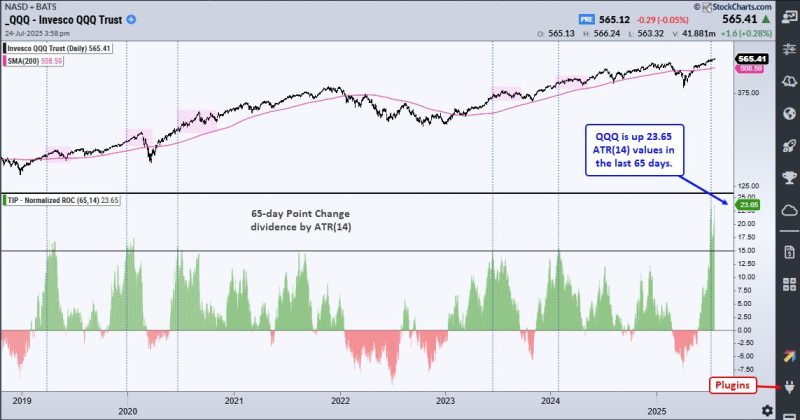

Technical analysis

This is a type of analysis where a trader looks at a chart and then identifies patterns. By looking at these patterns, the trader can predict whether the asset will continue rising or whether it will resume the downward trend.

Technical analysis is made up of two key parts: technical indicators and price action analysis. Indicators are tools created using mathematical formulas that use historical data to predict th future movements.

Some of the most popular technical indicators used in analysis are moving averages, Bollinger Bands, and the Relative Strength Index (RSI) among others.

Price action analysis, on the other hand, is a type of analysis that involves looking at chart patterns and then using the information to predict future trends. These patterns are divided into continuation and reversal patterns.

Examples of continuation patterns are bullish and bearish flag and bullish and bearish pennnats. Reversal patterns includ wedges, double-top, and head and shoulders pattern.

Fundamental analysis

This is a type of analysis where traders look at key factors that are affecting an asset’s price. The goal is to identify the intrinsic value of an asset and the key catalysts moving them.

For example, in stocks, you can look at key factors like the latest news, macro environment, and earnings. In forex trading, you could look at key factors like economic data and central bank decisions.

Most successful traders combine fundamental and technical analysis when making their trading decisions

The type of analysis that you decide to use is influenced by several things. For example, it is influenced by the type of trader that you are.

Scalpers don’t find fundamental analysis useful since they are only interested in chart movements. Long-term investors mostly focus on an asset’s fundamentals.

Second, it depends on the asset that you are trading. Some of the most popular assets in the market are stocks, currencies, indices, and commodities. In some cases, stock analysis is usually different from forex analysis.

Related » Best Time to Trade Daily? It Also Depends on the Asset!

Third, the timeframe for the trade can be useful when making decisions in analysis. For example, if you want to buy and hold an asset for a long time, it does not make sense to look at a 15-minute chart.

Summary

The most popular Nicholas Darvas quote recommends focusing on analysis and not forecasting. In this article, we have looked at the difference between the two and why you should focus on analysis.

We have also identified some of the best methods to analyse stocks and commodities.