Straddle vs. Strangle Options Strategy

This dynamic nature of options allows you to craft a position to fit your exact market view. Perhaps there’s a big Federal Reserve meeting coming up and you expect the market to overreact, but you don’t have a specific view as to which direction. In this case, you can use a market-neutral option spread like a straddle or strangle.

In the same vein, if the financial media and traders are making a big stink about something you deem a nothingburger, you can use strangles or straddles to take the view that the market will underreact to the news compared to what the market pricing expects.

Strangles and straddles are market-neutral options spreads which are apathetic to the direction that price moves. They instead allow a trader to express a view on the magnitude of the price move, regardless if the price moves up or down.

Let’s paint a quick hypothetical for demonstration.

There’s a Federal Reserve meeting in a week. There’s tons of talk about the possibility of a Fed pivot and the dramatic implications that’d have for the global economy. Looking at the S&P 500 options for that expiration, you see that the implied volatility is very high compared to past Fed meetings. Traders are expecting the Fed to drop a surprise in some sense.

Based on your own macro view, you’re unconvinced. You believe the Fed will continue their campaign of modest hikes of rates through the first half the year. In other words, you expect business as usual while the market expects radical change.

As an options trader, you’re fully aware that change equals volatility and the lack of change leads volatility to contract, making most options expire worthless. You decide to sell a straddle, which involves selling an at-the-money put and an at-the-money call simultaneously. Should your view pan out, you’ll be able to pocket a good portion of the premium you collected when you opened the trade.

What Is a Strangle?

A strangle is market-neutral options spread that involves the simultaneous purchase or sale of an out-of-the-money call and an out-of-the-money put. So if the underlying is trading at $20.00, you might buy the $18 strike put and the $22 strike call.

In this case, you’re hoping for a large price move in either direction, as your break-even price is often pretty far from the current underlying price.

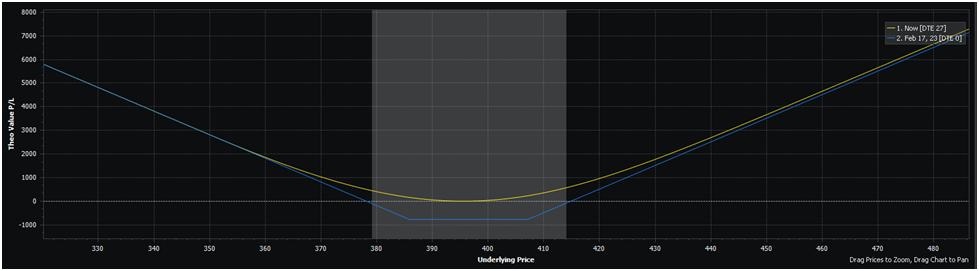

Let’s look at a brief example of a long strangle in $SPY using a .30 delta put and call with 27 days to expiration. Here’s the options we’re buying:

● SPY (underlying) price: 396.00

● 1 386 FEB 27 PUT @ 4.31 (-0.30 delta)

● 1 407 FEB 27 CALL @ 3.54 (0.30 delta)

● Cost of Position: 7.85

Here’s the payoff diagram of this position:

Once the position gets outside of the shaded gray area, the position is in-the-money. To provide some context to this position, SPY must move up or down roughly 4.5% for your position to be in-the-money.

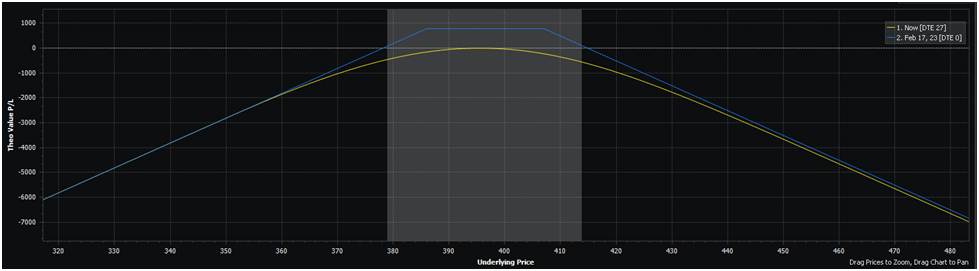

Let’s look at the same trade but from the short side:

The details of this trade are a mirror opposite of the previous example. You’d collect a $7.85 credit, and your break-even levels are outside of the shaded gray area. You’d make this trade if you expect SPY to remain within that range through expiration (27 days).

Strangle Strike Selection

Strike selection is a significant factor here and there’s no correct answer really.

The lower delta options you choose, the cheaper the spread and the lower the probability of profit will be. Perhaps you have a very specific market view, making strike selection obvious. But in most cases, novice option traders choose arbitrary strikes, which is a mistake. Strike selection is one of the most important aspects of trade structuring.

An easy way to start being more thoughtful about selecting strikes is to view an option’s delta as a rough approximation of the probability of expiring in-the-money. This simple trick provides a lot of context to option pricing.

You’ll see at-the-money options often hover around .50 delta, because the market basically has a 50/50 chance of going up or down over any time period not measured in years. As you get further from the money, deltas go down, which also makes intuitive sense.

Using this framework, you can look at a .20 delta strangle and think “the market thinks there’s a 20% chance of either of these options expiring in-the-money. Is my probability forecast higher or lower than that? If you can answer this question, your strike selection becomes not only easier, but far more thoughtful.

What is a Straddle?

A straddle is a market-neutral options spread involving the simultaneous purchase (or sale) of a call and put at the same strike price and expiration. The goal of the trade is to make a bet on volatility in a market-neutral fashion.

While any trade trade involving buying or selling a put and a call at the same strike price and expiration is technically a straddle, the majority of the time when we talk about straddles, we’re talking about an at-the-money straddle, meaning you buy a put and call at the ATM strike.

In other words, if implied volatility is 20%, but you expect future realized volatility to be much higher than that, buying a straddle would provide a profit regardless of which direction the market goes, or how it arrives there.

Along similar lines, if you expect realized volatility to be far less than 20%, you can short a straddle to profit from the market’s overestimation of volatility.

In a word, you want to buy a straddle when you think options are too cheap, and short straddles when options seem too expensive.

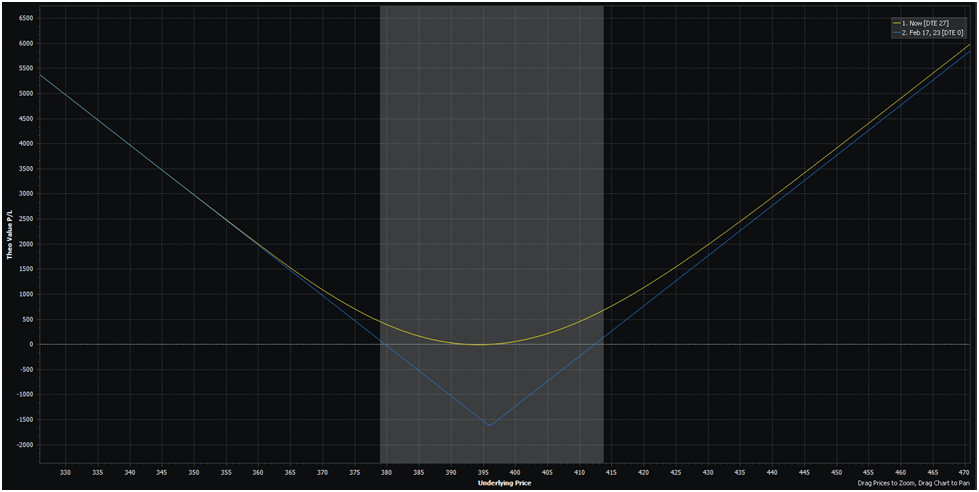

Here’s an example of a long straddle in SPY with 27 days to expiration. With SPY trading at 396 at the time of writing, we’d want to buy the 396 call and puts. Here’s how that’d look:

● SPY (underlying) at 396.00

● 1 396 FEB 27 CALL @ 8.59

● 1 396 FEB 27 CALL @ 7.69

● Total cost of trade: $16.28

As you can see, this ATM straddle costs more than double what our 0.30 delta strangle costs us. Being wrong on straddles is far more painful. But this payoff diagram shows us the upside to this trade-off:

What is most interesting here is that our 0.30 delta strangle from the previous example has nearly identical break-even points to this ATM straddle: around 379 and 414. However, looking at the shape of the P&L, you can see that you only experience your max P&L loss if the market goes absolutely nowhere and is still at 396 at expiration.

If the market moves even modestly in either direction, your trade begins to move in your favor. This is in stark contrast to our strangle, in which we experience maximum loss at a far wider range of prices.

So while you do have to shell out more premium to establish a straddle, it’s quite unlikely you’ll actually lose all of your premium.

The Similarities Between a Strangle and a Straddle

-

Both are Defined-Risk Options Spreads

Both the straddle and strangle involve buying two different options without selling any options to offset the premium paid. So the most you can lose in either a straddle or strangle is the premium you paid.

A defining trait of many defined-risk, long options strategies is the convexity afforded to you; you know the maximum you can lose is X, but your upside is theoretically unlimited. This can of course lead to occasional massive wins where the market basically trends in your direction until expiration.

-

Both Are Market-Neutral

Options allow you to express a more diverse array of market views than simply long or short. One of those is the ability to profit without having to predict the direction of price.

While market-neutral is an easy term to use because most understand it off the bat, that’s not entirely correct. You can more accurately call straddles or strangles delta-neutral because while you’re neutral on the direction of price, you’re still ultimately taking some sort of market view.

In the case of straddles and strangles, you’re taking a view on whether volatility will expand or contract. Or in other words, do you have conviction on whether the market will move more or less than the option market thinks? If so, you can profit from this view.

Put simply, if you expect the underlying to get more volatile before expiration, you want to be long volatility. Taking a long volatility view assumes that the options market’s implied volatility forecast is too low, making options too cheap.

Expressing a long volatility view in the context of a straddle or strangle means taking the long side of the trade (buying the options instead of shorting them).

Just as we described in the intro of this article, if you hold the view that the market is overhyping the significance of a catalyst, you make the same trade in reverse; you can short an at-the-money put and an ATM call, which is a short straddle. If realized volatility is lower than implied volatility, then you’ll end up pocketing a good portion of premium when you close the trade.

The Differences Between a Strangle and a Straddle

Straddles and strangles express very similar views; traders using them are either expressing a long or short volatility while remaining agnostic on price direction. Where they differ is the magnitude of their view, or how wrong they think the market pricing of implied volatility is.

From the long-volatility perspective, it’s cheaper to buy a strangle because you’re buying OTM options but the dilemma is that with cheaper OTM options, you have a lower probability of profiting from the trade. The market needs to move more to put you in the money.

If you flip this dilemma to the short side, you have the same problem. When shorting strangles, you have a high probability of collecting the entire premium at the conclusion of the trade, but when the market does make a big move, you experience a huge loss. So you can rack up several wins in a row only to see one loss knock out all of these gains.

ATM Straddles Have More Premium Than Strangles

At-the-money options have more premium than OTM options. So it follows that the straddle, a spread with two ATM options, would have far more premium than one with two OTM options, the strangle.

For this reason, systematic sellers of premium, what you might call the “Tastytrade crowd,” really like straddles for their high premium properties. This property of higher premium doesn’t make the straddle superior for premium sellers, as there’s no free lunch--premium sellers are paying for this higher level of premium with a lower win rate on their trades.

Straddles Have a Higher Probability of Profit

As it might’ve become clear throughout this article, constructing options spreads is all about tradeoffs. Want to put out a small amount of capital with the possibility of a huge win? You can do that, but you’ll hit on those trades a small portion of the time. Likewise, if you want to profit on most of your trades, you’re essentially paying for that in the sense that your frequent winners will be small profits and your infrequent losers will be much bigger.

This dynamic applies equally to the choice between straddles and strangles. A straddle requires more premium outlay with a higher possibility of profiting the trade, while strangles enable you to risk less overall on the trade, but you have to be “more right” on your market view to make a profit.

Your choice between these spreads when you want to make a market-neutral bet on volatility ultimately comes down to your own trading temperament, as well as which spread makes more sense given your market view.

Bottom Line: Straddles and Strangles Are About Volatility

For most traders, their introduction to options is related to an attraction to the leverage and convexity for their directional market bets. But as they peel the layers away and learn about the true nature of options, they learn that they’re far more than tools to get leveraged exposure to a stock or index.

The first and easiest lesson is the time aspect. The longer-dated the option, the more it costs. Optionality costs money. This is very easy to grasp. One-year options should cost more than one-day options.

The next step is understanding how market volatility relates to option pricing. It’s far less intuitive.

But, consider this hypothetical…

You’re offered the choice between paying the same price for a one-month at-the-money option on two different stocks.

One is highly volatile and frequently swings 10% daily. Tesla (TSLA) is a good example.

The second stock is a stable blue chip stock that doesn’t move around that much. Think something like Walmart (WMT) for instance.

Most would correctly choose the volatile stock. It’s common sense, right? After all, a stock like Tesla can move up or down 30% in a month, while a stock like Walmart often swings less than 10% in a month.

So like time, volatility has a price. But because future volatility is uncertain, that price is dynamic and subject to the opinion of the market. Like any market price, there are always opportunistic traders who profit from the inefficiencies of market pricing.

This is where volatility trading comes in. Think of strangles and straddles as the hammer and drill of volatility trading. They’re classic tools you reach for over and over again.

Remember, whenever you buy or sell an option, you’re making an implicit bet on volatility, whether you like it or not. If you buy an option, you’re taking the stance that volatility is too cheap.

Related articles

- How We Trade Straddle Option Strategy

- Exploiting Earnings Associated Rising Volatility

- Buying Premium Prior To Earnings - Does It Work?

- Can We Profit From Volatility Expansion Into Earnings?

- Long Straddle: A Guaranteed Win?

- Straddle, Strangle Or Reverse Iron Condor (RIC)?

- Selling Strangles Prior To Earnings

- Straddle Option Overview

- Long Straddle Through Earnings Backtest

- Straddles - Risks Determine When They Are Best Used

- Long And Short Straddles: Opposite Structures