Week Ahead: While Uptrend Stays Intact In Nifty, Stay Selective And Guard Profits At Higher Levels

It was the third week in a row that the markets extended their gains; the NIFTY had staged a breakout when it crossed above the 18880 levels. This has resulted in the NIFTY closing at yet another lifetime high. This has taken the markets into a mildly overbought zone; however, in the process, the index has raised their supports higher. The trading range remained modest; NIFTY oscillated in a 268.25 points range in the past five sessions. While extending the move higher as mentioned, the headline index closed with a net gain of 232.70 points (+1.20%) on a weekly basis.

Going by the derivatives data, there is a high accumulation of the OI near 19800-19900 levels. Going by this data, one can expect the markets to find stiff resistance near that zone over the coming days even if the current uptrend is to extend itself. Volatility also dropped; the INDIAVIX came off by 7.37% to 10.38 on a weekly basis. This is something that can push the markets into some consolidation; these low values of VIX have the potential to keep the markets exposed to violent profit-taking bouts from current levels.

The coming week is again set to see a quiet start to the week; the volatility is likely to increase and the levels of 19700 and 19865 can act as resistance points. The support levels come in at 19310 and 19200.

The weekly RSI is 71.87; it has marked a fresh 14-period high and now remains mildly overbought. The MACD is bullish and stays above the signal line. The widening Histogram shows accelerating momentum in the current uptrend.

All in all, the overall technical structure of the markets remains buoyant and there is nothing to suggest based on which we can say that the markets may be staring at any major correction. The only thing that one needs to stay cautious of is the low levels of VIX which leave the market exposed to profit-taking bouts from current and/or higher levels.

Besides this, even if the markets slip under any consolidation, the recent price action has dragged the supports higher to the 19000-19200 zone. So long as the NIFTY is above this zone, the trend would stay intact. We are likely to see sectors like IT, select midcaps, Energy, Metal, and Pharma do well. It is recommended to not only keep fresh purchases selective but also guard the profits vigilantly at higher levels.

Sector Analysis for the coming week

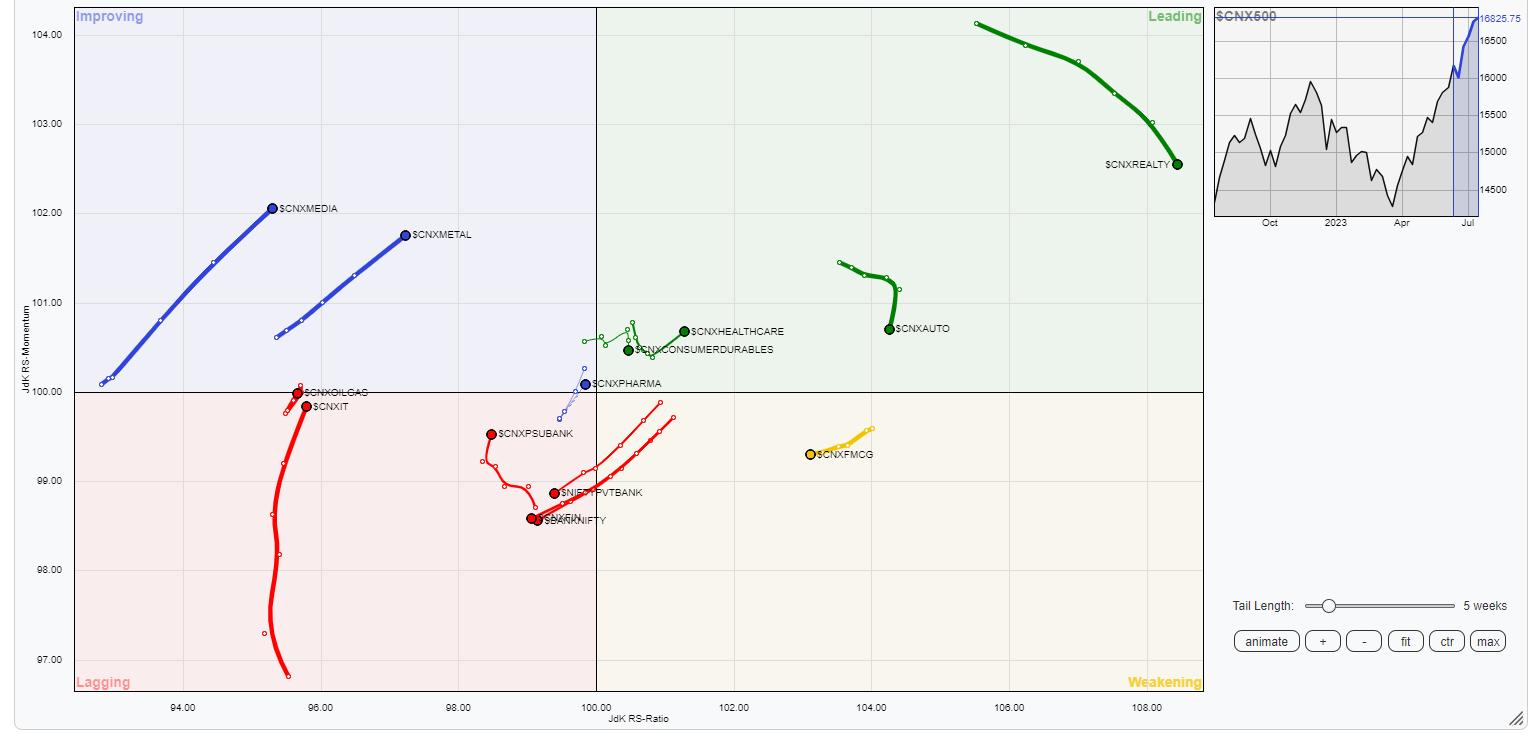

In our look at Relative Rotation Graphs®, we compared various sectors against CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all the stocks listed.

The analysis of Relative Rotation Graphs (RRG) does not show any major changes in the sectoral setup as compared to the previous week. The Nifty Realty, Auto, Consumption, and Midcap indices continue to remain inside the leading quadrant. This is set to see these pockets relatively outperforming the broader markets.

Nifty PSE, Infrastructure, and FMCG index are inside the weakening quadrant. Stock-specific performance may be seen but overall these groups may not show any strong outperformance.

The Nifty Bank has rolled inside the lagging quadrant. The commodities and the financial services index are also inside the lagging quadrant along with the Services sector index. The Nifty PSU Bank and the IT index are also inside the lagging quadrant but they are seen improving their relative momentum against the broader markets.

The Nifty Metal and the Media indices are comfortably placed inside the improving quadrant. The Energy index, which is also inside the improving quadrant is seen giving up on its relative momentum against the broader markets.

Important Note: RRG™ charts show the relative strength and momentum of a group of stocks. In the above Chart, they show relative performance against NIFTY500 Index (Broader Markets) and should not be used directly as buy or sell signals.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst