Potential UAW strike: Where labor talks stand and what’s at stake

The United Auto Workers are getting down to the wire in negotiations with the “Big Three” U.S. automakers — General Motors, Ford and Chrysler maker Stellantis — over a new labor contract for around 146,000 workers.

Talks have been rocky, and some industry watchers foresee a fairly high likelihood of a strike, which could take place as soon as the current contract expires one minute before midnight next Thursday.

Here’s where the dispute between the union and the so-called Detroit 3 stands and what might come next.

How close are the parties to reaching a deal?

As of Friday evening, GM, Ford and Stellantis had each submitted at least one proposal to the UAW, though the union has indicated it isn’t ready to accept any of them yet. Talks appear set to continue into next week.

As is common in high-profile labor negotiations, the rhetoric has been heated. UAW President Shawn Fain earlier panned some automakers’ offers and emphasized that union workers stand ready to head to the picket lines, though he told a crowd in Detroit over Labor Day weekend: “Our intent is not to strike. Our intent is to get a fair agreement.”

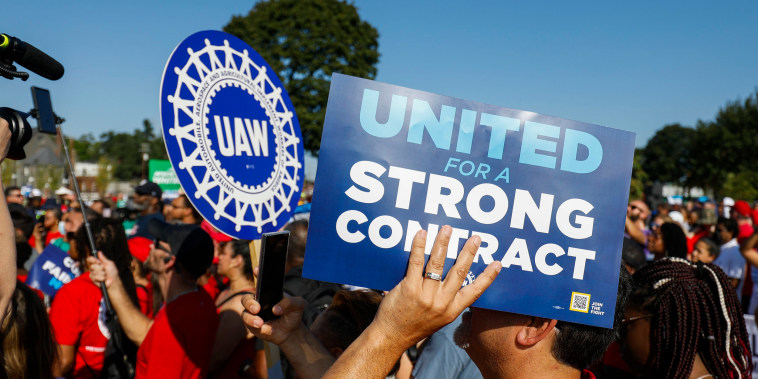

United Auto Workers members and others gather for a rally after marching in the Labor Day parade in Detroit on Sept. 4, 2023.Bill Pugliano / Getty Images

The union is negotiating with all three automakers simultaneously, in a break from previous rounds of contract talks. The UAW also recently filed a complaint with the National Labor Relations Board accusing GM and Stellantis of failing to bargain in good faith and in a timely fashion.

The automakers have said they’re willing to negotiate in good faith and have pushed back against union demands they say are excessive — in some cases warning that big pay hikes could cut into investments needed to make the transition to electric vehicles.

What happens if there’s no deal by Sept. 14?

The current UAW contracts expire at 11:59 p.m. next Thursday, and rank-and-file workers voted overwhelmingly late last month to authorize a strike in case handshake agreements with any of the companies aren’t in place by then.

A strike at one, two or all three automakers could happen at any time from next Friday onward, though multiple strikes could be called at different times. That means up to 146,000 workers could wind up picketing simultaneously, though the total could be far fewer if a strike is limited to just one or two of the companies instead of all three.

What are workers’ top demands?

Fain has promoted the union’s “ambitious” push for more generous wages and benefits. The UAW is seeking a 40% wage hike over four years (amounting to 46% compounded), along with cost-of-living increases; beefed-up retirement benefits, including pensions on par with what autoworkers previously received; and a shortened 32-hour workweek, down from 40.

United Auto Workers President Shawn Fain, second left, at a Labor Day parade in Detroit on Monday. Paul Sancya / AP

The UAW has pointed to Big Three executives’ pay in demanding higher pay for workers. For example, GM chief Mary Barra’s compensation grew by 32.5% from 2018 to 2022. During the same period, the median GM employee’s pay grew by 2.8%, public filings show.

Ford appointed a new CEO in 2020, and the pay jumped 18% from 2018 to 2022, when the median employee’s pay rose 16.1%. Data for Stellantis is unavailable because the company was formed only in 2021 and is now headquartered in Amsterdam, where pay disclosure rules are different from those in the U.S.

How much would a strike cost car companies and workers?

Even a strike lasting just 10 days could cost the Big Three automakers at least $5 billion, according to a recent estimate by the Anderson Economic Group.

The immediate impact would be halted production. IHS analysts estimate that for every week workers are on strike, GM’s output would fall by 55,000 vehicles a week and Ford’s by about 65,000 a week.

GM and Ford stand to lose $2.5 billion and $3 billion in revenue, respectively, for every week a strike lasts, Goldman Sachs Equity Research estimated. By comparison, agreeing to a 40% wage bump for UAW members would cost GM $4 billion to $5 billion and Ford $5 billion to $6 billion over four years. Goldman didn’t provide estimates for Stellantis.

The UAW has amassed $825 million in a strike fund that would pay eligible members $500 a week during a work stoppage, a sum that is expected to last for up to around 11 weeks but could be depleted sooner because of health care costs.

Would vehicle prices rise if UAW workers strike?

If fewer new cars are produced, inventory on dealer lots would dwindle, which could push prices higher.

Following the pandemic and a global supply chain crunch in materials and parts, U.S. new-vehicle inventory levels are still tighter this year than they were during the last round of bargaining, in 2019.

Cox Automotive estimated the supply of new vehicles at the end of July as enough to cover 56 days of sales — below the 60-day mark considered “normal” and the 66-day measure recorded in the lead-up to 2019 UAW negotiations.

The impact could be more muted for Ford and Stellantis brands like Jeep, Dodge, Chrysler and Ram, which Cox said had above-average levels of supply. But GM brands like Cadillac and Chevrolet have slightly below-average supplies.

When was the last time autoworkers went on strike?

In 2019, autoworkers at GM went on a 40-day strike that cost the company an estimated $3.6 billion that year. The work stoppage pushed Michigan’s economy into a single-quarter recession.

Why aren’t workers from other car companies threatening to strike?

GM, Ford and Stellantis are the only major automakers whose U.S. workers are unionized.

Foreign automakers such as Toyota, Honda, Volkswagen, Mercedes and Hyundai are among those operating nonunion plants in the U.S. — including outside of Michigan. In the electric vehicle space, newer entrants like Tesla, Rivian and VinFast also build in the U.S., similarly without union labor.