Is the Banking System on the Verge of Systemic Implosion? What to Look Out For

2024 will be marked by a massive string of bank failures!!! Well, according to a few economists on the far end of the mainstream economic spectrum, that is.

This sounds alarming, of course, but does the fringe position of its proponents invalidate the thesis?

No Bank Is Safe, as Nearly Every Bank Is Insolvent

The core reason for this impending catastrophe can be linked to the insolvency of almost every bank.

But how’s that even possible? How can they fundamentally validate such an outlandish claim? It’s the consequence of the Federal Reserve’s interest rate policies. With interest rates soaring, the value of banks’ government debt holdings is substantially underwater—enough to drown banks’ reserves in a sea of red.

So what’s the big takeaway from the doom-and-gloom pulpit? It’s this: the big implosion is coming, and it’s happening this year.

“But hold on,” the moderate view says, “Not so fast; it can’t be that bad, even if the outcome isn’t all that good.”

Let’s be objective, starting with: What do the technicals say?

The Macro View: Too-Big-To-Fail and Regional Banks

While the risk of a few more bank failures is plausible (since a few tend to happen each year, on average and on a regional level), a string of failures triggering a systemic banking crisis is something else. Can it happen?

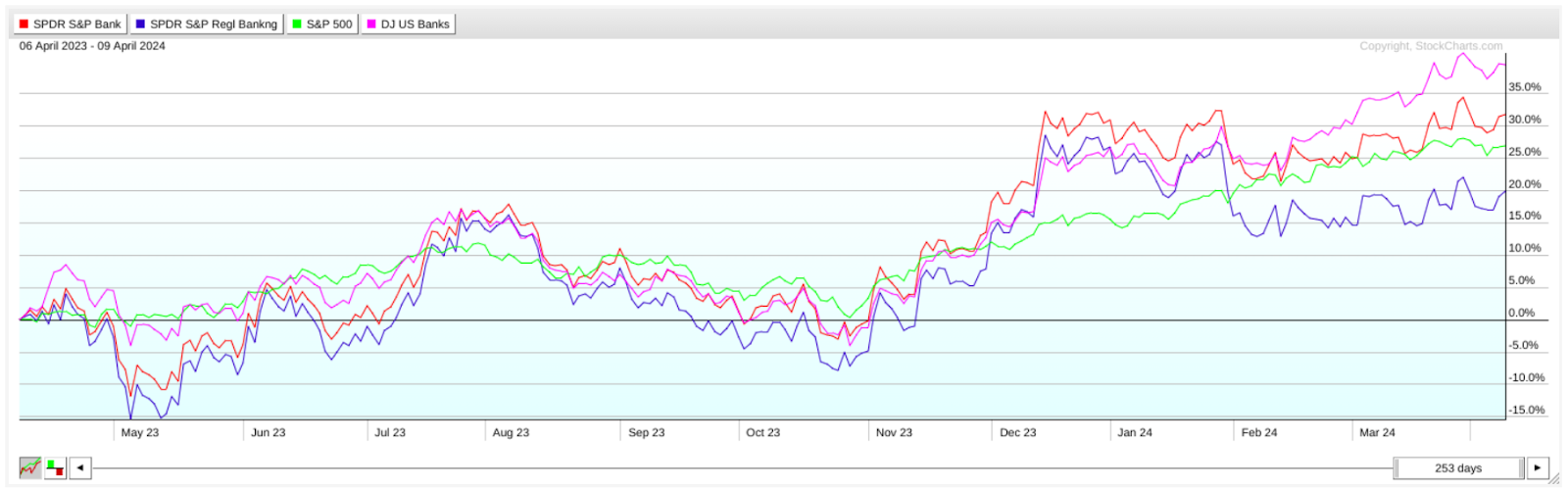

CHART 1. PERFCHART OF SMALL AND LARGER BANKS AND THE S&P 500. Note their rapid recovery since the March 2023 banking crisis (quickly stemmed by the Federal Reserve’s Bank Term Funding Program, which ended on March 11, 2024).Chart source: StockCharts.com. For educational purposes.

Last year, Silvergate Bank, Silicon Valley Bank (SVB), and Signature Bank collapsed, triggering what would have been a much larger crisis had the Federal Reserve not stepped in with its Bank Term Funding Program (BTFP). BTFP aimed to stabilize the banking system by providing loans to banks and credit unions against collateral like US Treasuries and mortgage-backed securities valued at par.

Looking at the chart, you can see how large banks (using KBE and $DJUSBK as proxies) and regional banks (using KRE as a proxy) underwent a rapid recovery. Compared to a year ago, large banks are outperforming the S&P 500 ($SPX) while regional banks, the laggards, are well within positive territory.

The Channel Broke

CHART 2. DAILY CHART OF KBE. Price just broke below the upward trend channel, but the drop in momentum might have forecasted this decline a month ago.Chart source: StockCharts.com. For educational purposes.

Momentum for KBE, an industry proxy for large banks, began hinting at a bearish divergence in momentum in early March based on the Chaikin Money Flow’s (CMF) extreme downward slope into negative territory. Its rise against the S&P 500 was tepid and steady, but its underperformance against the Dow Jones US Bank Index was as silent as it was foreboding.

KBE finally broke below its uptrend price channel, and the next set of support levels are at the $41, $39, and $37 range. The current decline was triggered by Wednesday’s negative Consumer Price Index (CPI) results, soon to be followed by Thursday’s Producer Price Index (PPI) numbers. How low can KBE drop? Pay attention to the current earnings season—read the figures, analyze CEO-issued guidance, and consider (if it’s sensible enough) a few analyst forecasts that aren’t just following (or regurgitating) mainstream opinions.

What about regional banks?

CHART 3. DAILY CHART OF KRE. Regional banks are drastically underperforming their larger counterparts in the banking sector. Chart source: StockCharts.com. For educational purposes.

On March 27, the article KRE’s Impending Plunge: What This Emerging Crisis Means forecasted this decline based on similar technical and fundamental assessments. You can see the divergence between KRE’s price and the CMF. What wasn’t discussed, though, was KRE’s silent (through drastic) underperformance against its larger banking sector counterpart ($DJUSBK).

The potential support levels are also outlined in the chart above ($45, $44, and $43 range) though its continuing slide, and whether it plunges further will be driven by fundamental conditions. Like KBE, pay attention to the current earnings season’s figures and news.

Is the Implosion Coming?

In the shadow of last year’s banking failures, several economists from the margins of mainstream forecasts ominously predict a widespread banking collapse in 2024. This dire prediction is rooted in the belief that nearly every bank teeters on the brink of insolvency, a crisis precipitated by the Federal Reserve’s interest rate policies, which have left banks’ reserves vulnerable due to devalued government debt holdings.

Of course, this could all be alarmist rhetoric. But if it does play out, partially or entirely, the technical levels and indicators at play can help you navigate the circumstances should you decide to take action, whether it’s bullish or bearish.

Disclaimer: The content in this article is the writer’s opinion and does not constitute financial advice. StockCharts.com does not endorse or guarantee any claims made in this article. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.