NVDA, TSMC, and Broadcom: Top Semiconductor Plays as SMH Hits New Highs

In the last quarter of 2024, semiconductors have been walking a tightrope between tariff fears and supply chain uncertainties. Geopolitical tensions between the US and China cast a long shadow over the industry, holding our proxy, VanEck Vectors Semiconductor ETF (SMH), in a consolidated range from October 2024 through January.

However, with new policies and developments in Washington, the narrative has shifted, as evidenced by SMH’s upside breakout in this weekly chart.

FIGURE 1. WEEKLY CHART OF SMH. The new narratives in DC have injected a fresh dose of optimism into the semiconductor industry, causing SMH to break out of its 3-month range.

SMH broke above resistance at the $261 level and is on its way toward testing its all-time high of $281.82.

What changed the narrative?

Four factors have likely contributed to this renewed optimism in semiconductors:

- Tariffs on China may not be as severe as initially expected.

- The $500 billion “Stargate” AI initiative has sent AI-related chipmakers higher.

- The new administration’s economic policies, including tax cuts, deregulation, and increased government spending, have sparked a broad market rally, benefiting tech.

- A renewed push for reshoring and domestic semiconductor manufacturing is seen to reduce risks, positioning US chipmakers for long-term growth.

With these factors in play, let’s examine three semiconductor stocks — Nvidia (NVDA), Taiwan Semiconductor Company (TSM), and Broadcom (AVGO) — all of which are positioned to benefit from these changes.

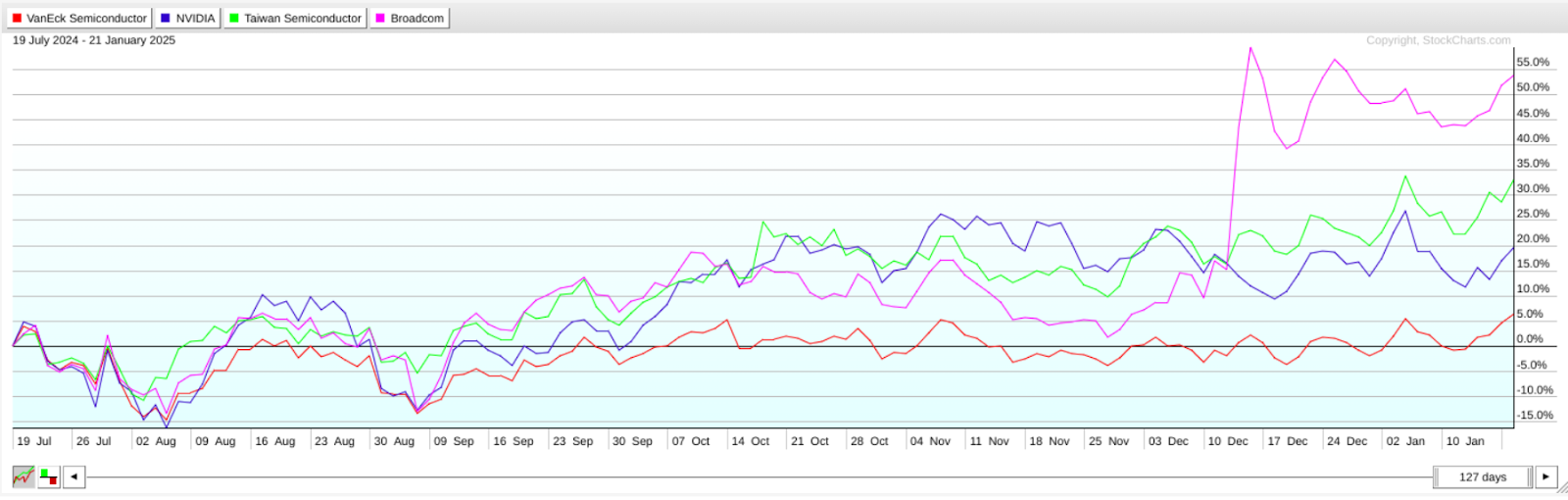

FIGURE 2. SIX-MONTH PERFCHARTS VIEW OF SMH, NVDA, TSM, AND AVGO. Note AVGO’s jump in December.Chart source: StockChars.com. For educational purposes.

Using StockCharts’ PerfCharts charting tool, you can view a comparative performance of these stocks against our industry proxy SMH. All three stocks began outperforming their chip industry peers, but only AVGO made a notable jump in December.

So, let’s look at a daily chart of AVGO’s price action.

FIGURE 3. DAILY CHART OF AVGO. It’s a technically strong stock that may be due for a pullback.Chart source: StockChars.com. For educational purposes.

- Strong financial performance and significant advancements in proprietary AI tech drove the company’s 40% jump in December.

- AVGO’s StockCharts Technical Rank (SCTR) score rose above the 90-line threshold, signaling bullishness across multiple indicators and timeframes.

Yet there are signs indicating near-term weakness.

- The Money Flow Index (MFI) is declining as AVGO attempts to rally above its all-time high of $251; a bearish divergence suggesting the likelihood of a pullback.

- The Accumulation/Distribution Line (ADL) on the chart (pink line) has dropped below the price action, indicating a drop in money flow which can precede a price decline.

Nevertheless, AVGO remains a technically strong stock with a promising outlook in light of the current AI developments. If you’re considering a long position, use the Quadrant Lines to help decide your entry point. A pullback that holds within the top two quadrants signals strength and may present a solid buying opportunity. However, if AVGO falls below the middle line into the third quadrant, it could indicate weakness, warranting a reassessment of the stock’s momentum and overall bullish thesis.

Next, let’s shift over to a daily chart of TSM.

FIGURE 4. DAILY CHART OF TSM. It’s been smooth sailing, and if the advance continues, it’s crucial to find a near-term entry point.Chart source: StockChars.com. For educational purposes.

TSM is well-positioned to benefit from the developments and policy changes discussed earlier in this article. As the world’s largest semiconductor foundry, TSM plays a crucial role in AI chip manufacturing. Additionally, its expansion into the US includes new facilities in Arizona, which can help mitigate some supply-chain risks, though Taiwan remains its primary hub.

- TSM has notched an all-time high.

- Its SCTR reading is just below the ultra-bullish 90 threshold.

- Its Relative Strength Index (RSI) reading suggests steady upward momentum with plenty more room to run (before entering overbought territory).

If you’re considering entering a long position in TSM, you might wait for a retracement to the middle Bollinger Band, as it recently closed above the upper band. According to John Bollinger, the indicator’s developer, the bands should contain 88–89% of price action, which makes a move outside the bands significant.

Last but not least, here’s a daily chart of Nvidia (NVDA), the world’s leading AI chipmaker.

FIGURE 5. DAILY CHART OF NVDA. Momentum and volume are dwindling as price looks to be trading rangebound.Chart source: StockChars.com. For educational purposes.

NVDA is arguably the most favored AI chip stock on Wall Street. Nevertheless, the Chaikin Money Flow (CMF) and RSI indicate that the stock’s volume and momentum appear subdued, suggesting the market may be waiting for a catalyst to drive the next move.

While NVDA’s attempt to break above its all-time high of $153 appears to be waning, keep a close eye on support at the $130 range. A close below this, should that happen, can lead to further downside. The next level of support below that line would be near $115.

At the Close

Add SMH, AVGO, TSM, and NVDA to your ChartLists and monitor the key levels closely. Stay updated on news and policy developments from the new administration, as these could impact the semiconductor industry. While market sentiment remains bullish, watch for key technical levels and potential catalysts that could drive further upside—or signal a shift in momentum.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.