Stock Option Strike (Exercise) Price Explained

.jpg.85d912d4501e4cd9fbe9026497f64976.jpg)

(Most traded options are American options. The underlying can be bought or sold anytime . However 'European' options, which can only be exercised on contract expiration, exist too ).

However it is worth knowing that there are so called European options in existence too, which can only be exercised on contract expiration).

Options come in two main types: calls which give the right to buy and puts which give the right to sell.

:max_bytes(150000):strip_icc():format(webp)/strikeprice__definition_0907-a6b3c81838294842b654fa37ca60a3f5.jpg)

Option Strike (Exercise) Price Definition

The strike (or exercise) price of an call option is the fixed price at which a holder can purchase the underlying stock or financial instrument sometime in the future. Likewise, the strike price of a put is the price at which a stock/instrument can be sold.

Options Quotes

Options are quoted via options chains on the Chicago Board Options Exchange (CBOE) and each by:

- Underlying Security (usually, but not always, a stock such as AAPL)

- Option Type: A Call (the right, but not obligation, to buy the underlying) or Put (the right, but not obligation, to sell the underlying)

- Expiry date: when an option has to be used before it expires worthless. Options are time limited as they can only be used up to this set expiry date.

- Exercise Price. Also known as the strike price, this is the price at which the underlying can be bought (call) or sold (put)

Let’s look at an example:

Suppose you see via your broker, via an options chain like the one above, an option quoted: Nov 20 200 Call 1.50

In other words the underlying is AAPL (Apple stock), this is a call option with an expiry of November 2020 and exercise price of $200. The price per option is $1.50.

Option contracts are usually in blocks of 100 and so one contract would cost $150 ($1.50 x 100) and allow you to buy 100 AAPL shares for $20,000 ($200 x 100) anytime between now and November 2020.

Why Is Strike Price Important?

Suppose in the above example you instead looked at the following option: AAPL Nov 20 180 Call

This is the same as before, but now the right purchased is to buy at $180.

Do you think this is more or less valuable to the owner? More valuable, of course, and hence we would expect the quoted value to be much higher than $1.50 (depending also on the current stock price and implied volatility).

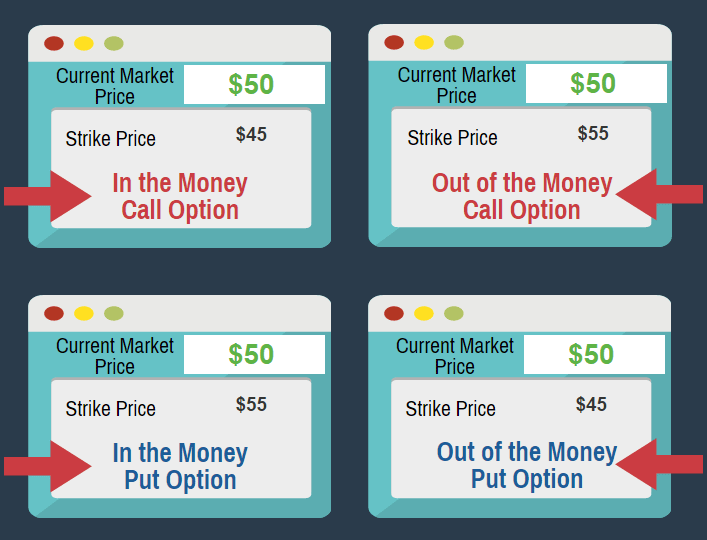

Moneyness

Strike price is also relevant to the concept of moneyness.

An option is at-the-money if the strike price and the current stock price are the same.

It is in-the-money if the strike price is lower (for calls) or higher (for puts) than current price. It is out-of-the-money if the exercise price is higher (for calls) or lower (for puts).

So for example if Apple’s share price is $190 our AAPL Nov 20 200 Call is out of the money, but the AAPL Nov 20 180 Call is in the money.

-

In the Money: In the case of a call option, the option is said to be ‘in the money if the market price of the underlying stock is above the exercise price and In the case of a put option, if the market price of the stock is below the strike price then it is considered as ‘in the money.’

-

Out of the Money: In call option, if the exercise price of the underlying security is above its market price, then the option is said to be ‘out of the money, whereas in the put option, if the strike price is below the market price of the security, then it is said to be as ‘out of the money.’

-

At the Money: If the exercise price is the same as the market price of the underlying stock, then at that time, both the call and the put options are at the money situation.

Image by wallstreetmojo.com

The Bottom Line

An option's strike price tells you at what price you can buy (in the case of a call) or sell (for a put) the underlying security before the contract expires. The difference between the strike price and the current market price is called the option's "moneyness," a measure of its intrinsic value. In-the-money options have intrinsic value since they can be exercised at a strike price that is more favorable than the current market price, for a guaranteed profit. Out-of-the-money options do not have intrinsic value, but still contain extrinsic, or time value since the underlying may move to the strike before expiration. At-the-money options have strikes at or very close to the current market price and are often the most liquid and active contracts in a name.

About the Author: Chris Young has a mathematics degree and 18 years finance experience. Chris is British by background but has worked in the US and lately in Australia. His interest in options was first aroused by the ‘Trading Options’ section of the Financial Times (of London). He decided to bring this knowledge to a wider audience and founded Epsilon Options in 2012.

Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!

Join SteadyOptions Now!